Share this

Gautam Adani net worth fell by over $10 billion following a US arrest warrant, leading to a $30 billion loss in the Group’s market value. The fraud allegations have caused significant financial and market instability.

Indian Billionaire Gautam Adani Faces Major Financial Setback

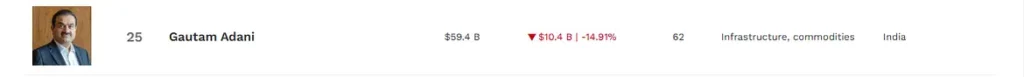

Indian billionaire and business tycoon Gautam A has seen his net worth drop by more than $10 billion, a nearly 15 percent decline to $59.4 billion. This dramatic decrease follows a US court’s arrest warrant on bribery allegations. These charges have severely impacted Adani’s finances, causing his net worth to temporarily dip to $58.5 billion before slightly recovering. As a result, Adani fell on Forbes’ Rich List from 22nd to 25th globally. He remains the second richest individual in India, behind Mukesh Ambani.

Adani Group’s Market Value Suffers $30 Billion Loss

The US arrest warrant has also affected the Adani Group’s market value. The group lost $30 billion during Thursday’s trade in India, reducing its combined market capitalization to $148 billion. This is a significant drop from the $235 billion market value the group had before last year’s Hindenburg report. Shares of Green Energy plummeted by 16 percent. Stocks of other firms within the conglomerate, including Adani Enterprises, fell by more than 10 percent.

Fraud Allegations Shake Corporate Empire

US authorities have charged Adani and seven other defendants with multiple counts of fraud. These allegations involve a firm listed in New York and have impacted American investors. The US Attorney’s Office for the Eastern District of New York unsealed the criminal charges. Some conspirators referred to Adani using code names like “Numero uno” and “the big man.” Sagar Adani tracked bribe specifics using his cellphone.

Global Impact on Investments

These allegations have had a global impact. Shares in GQG Partners, an Australia-listed investment firm and a major Adani backer, fell by 20 percent. This marks its largest one-day drop since listing three years ago. Adani dollar bonds also suffered, with prices falling between 3-5 cents on bonds for Adani Ports and Special Economic Zone. The firm is closely monitoring the charges as the situation develops.

Adani’s Ongoing Legal Battles and Future Outlook

The US Attorney’s Office has charged five other defendants with conspiring to violate the Foreign Corrupt Practices Act, a US anti-bribery law. They also charged four defendants with conspiring to obstruct justice. None of the defendants are currently in custody, and Gautam A remains in India. As the legal battles unfold, the Adani’s Group’s future and its impact on the global market remain uncertain. The financial community is closely watching the developments, anticipating further fluctuations in Adani’s net worth and the group’s market value.